HOMELEND

WHAT IS HOMELEND

Homelend is a decentralized platform enabling the next generation of mortgage financing for homebuyers. Homelend creates an interface for direct interaction between borrowers, lenders and other parties involved in the mortgage value chain. In doing so, it enables mortgage crowdfunding using a peer-to-peer model with the security, transparency and automation provided by distributed ledger technology (DLT) and smart contracts.

- HIPOTEK LOANS AT THE HEART OF THE COMMUNITY

Owning a house is one of the basic human needs - the need for people can only afford a mortgage from a bank. In the United States alone, more than 8 million mortgages are granted each year.

- ARCHAIC INDUSTRY OF $ 31 BILLION YEAR FOR DISTURBANCE

The US mortgage market is worth $ 14 trillion and the global market is expected to reach $ 31 trillion by the end of 2018. However, the traditional mortgage system remains very primitive.

This system is based on a long and complex paper process involving various intermediaries - a process of inefficiency and overhead for borrowers and lenders. In addition, most mortgage borrowers, including millions of credit worthy individuals obtain a home loan due to outdated appraisal criteria.

Comment Homelend plate-forme

Homelend connects borrowers and lenders in a unique way, controlled by smart contracts, without involving intermediaries. The borrower will apply for a mortgage on the Homelend platform. This application will be verified and approved (or not) with the help of machine learning and artificial intelligence technology. Then each lender will be able to finance the pre-approved loan by purchasing "Iris" from them. All processes will be controlled by the intelligent protocol of the contract, not by humans. In the Homelend platform, information gathering is done in an "all-digital" way. Even the data in the paper documents must be transferred to a digital repository storage technology based on the general ledger. This data is provided by the user and verified by a professional verification provider.

Financial flows to Homelend, the flow of financial resources from lenders to borrowers (and, finally, to sellers) run only through smart contracts. There are financial services, controls or decision-making by Homelend Once the buyer receives a pre-approval of the system, some properties, the mortgage is "registered" on the Homelend platform. So, the borrower has made a certain face, and the amount of credit is determined.

Business model

Homelines are being developed as a blockchain solution for the likelihood of housing finance for many individuals and families. Our value proposition for a P2P-driven social and incremental approach is to use technology for the benefit of society. However, Homelend also relies on a healthy and profitable business model, aware of reaching underserved market addresses. On the one hand, Homelend creates investment opportunities for many people, with solutions that unite traditional industries such as real estate, with innovative technologies such as blockchain. On the other hand, it is possible for many people who do not

ADVANTAGES OF THE HOMELEND

- From the manual to the long, effective and efficient

By integrating business logic into smart contracts, digitizing documentation and eliminating unnecessary processes, Homelend automatically launches the end-to-end process from 50 days to less than 20 days.

- Expensive intermediaries to unprofitable intermediates

The certainty, security and transparency offered by DLT make it possible to record transactions, including loans, without the Bank acting as an intermediary. This will reduce costs for borrowers and lenders while minimizing the distance between them.

- From clumsy ambiguity to seamless and user-friendly

Homelend aims to create a lending process that is not only smart, but also simple and fair. This will allow borrowers to apply for loans, track the status of their claim at any time, and interact directly with mortgage lenders.

- A reliable and reliable safe

Paper-based processes and centralization are the main factors behind the insecurity and vulnerability that characterize the traditional mortgage industry. The unique features of DLT and smart contracts enable Homer to provide a platform for people to process large amounts of money reliably, transparently and securely.

GENERATING TOKEN EVENTS

In this chapter, we will discuss the use of usage, function, and token characteristics of the Token Generation Event (TGE), also known as Initial Coin Offering (ICO). This token, called simply "merged chips" and identified as HMD token, will be powered by the P2P loan platform, as will be discussed in more detail. The option to create a utility token has been carefully examined by the founding team and is based on a reason and an objective. We explain below the reasons for issuing HMD tokens.

The Homelend Token Token Token (HMD) is a fuel that leverages Homelend's peer-to-peer lending platform. Its main functionality is to provide access to the Homelend Token platform. This utility also plays a vital role in providing a fast, transparent, easy-to-use, easy-to-use workflow.

TOKEN HOMELEND (HMD)

The symbolic HMD is a fuel that strengthens homelend peer-to-peer lending platforms. Its main function is to provide access to the Homelend Token platform. The utility also plays an important role in enabling a fast, seamless, and easy-to-use workflow.

All tokens can be converted to and from HMD

Specification

- Le symbole: HMD

- Total stocks: 250 million +

- Standard: ERC-20

- Nominal: 1 ETH = HMD 1 600

- Devise: BTC, ETH, USD

- Softcap: 5 million US dollars

- Hardcap: 30 millions de dollars

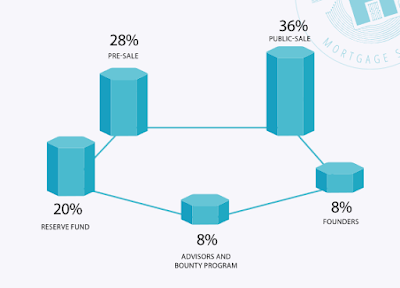

- 28% of pre-sales

- 36% of general sales

- Reserve Fund 20%

- 8% of counselors and the Bounty program

- Founder 8%

Using the results

- General Administration 25%

- 40% development

- 35% of society and building marketing

ROADMAP

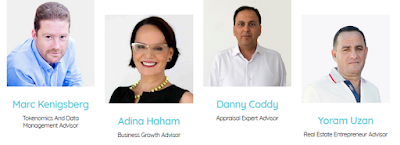

Team and advisor

For informatio:

- Site Web : https://homelend.io/

- WHITEPAPER : https://homelend.io/files/Whitepaper.pdf

- Twitter : https://twitter.com/homelendhmd

- Facebook: https://www.facebook.com/HMDHomelend/

- TELEGRAM : https://t.me/HomelendPlatform/

- MEDIUM: https://medium.com/homelendblog

- LINKEDIN : https://www.linkedin.com/company/18236177/

- Reddit : https://www.reddit.com/r/Homelend/

- ANN THREAD : https://bitcointalk.org/index.php?topic=3407541

- BitcoinTalk: https://bitcointalk.org/index.php?action=profile;u=1255738

Tidak ada komentar:

Posting Komentar