CREDITO

Introduction

Credito is a decentralized credit intelligence network providing credit scores, transaction scores and lending marketplace powered by Ethereum blockchain, Smart Contracts and IPFS, bringing enhanced transparency and reliability.

Credito brings Financial Inclusion to the “Credit Invisibles” by providing accurate and reliable credit scores. A relatively high proportion of young people were credit invisible or unscored. That’s not surprising, since they haven’t had much time to build a credit history. For some, however, not building credit as a young adult could be setting the stage for a lifetime of credit invisibility. People who don’t have a credit score or credit history may find it more difficult to rent an apartment, buy a car, purchase a home, and, of course, get a credit card. In short, it shuts them out of many common financial transactions.

Credito is building a Credit Intelligence Network for the credit industry to prevent Credit Risk by identifying fraudulent transactions as they happen, allowing the industry to take well informed decisions. Although financial institutions are normally known as one of the most strictly regulated sectors, they are still a target for fraudsters. The consequences of fraud are not insignificant, resulting in financial distress for both banks and customers. While the financial institutions are active in the quest to identify fraud and reduce costs of fraud, they still lack a true global intelligence of all known frauds and compromises.

Credito is introducing a decentralized collateralized lending marketplace and enables connections between lenders and borrowers located anywhere in the world. This removes physical constraints and reduces the traditional lending costs and management fees, thus creating a better credit marketplace than anything available today.

Problem Credito

Despite the efforts made by banks, card issuers, and merchants, credit card fraud continues to grow faster than credit card spending. Data breaches have resulted in more card details being compromised, and the growth in online shopping has led to more opportunities for ecommerce fraud.

According to a 2016 report by Nilson, losses from credit card fraud amounted to $21.8 billion in 2015 that’s an increase of 162% from the 2010 figure which was $8 billion. The losses for 2016 are already estimated at over $24 billion, and these losses are expected to reach $31 billion by 2020.

- MonopolyThe global credit intelligence is controlled by a handful of credit bureaus, and it has been alleged many times that their scoring models are outdated, flawed, and not portable as they are specific to a country or a region. “More than one in five consumers have a ‘potentially material error’ in their credit file that makes them look riskier than they are, and consumers contacted one of the big three credit reporting agencies to dispute information Eight million times an year”.

- SecurityThe recent Equifax hack exposed 140 million+ identities and personal information to the hackers and termed as the worst security breach in US history.There were over 15 million victims of identity theft or fraud in 2016 with the total amount stolen being $16 Billion.

- Centralized InformationThe data collected by credit bureaus is centralized. It is a common misconception that these bureaus exchange information automatically, which is not true. These agencies are separate businesses providing similar services for a fee.

- PortabilityAs the credit scores are not portable, a low risk borrower may be denied access to credit when they move internationally, having to rebuild his credit worthiness from scratch.

- Outdated Analytics and Incomplete informationAs the information becomes more centralized it becomes monopolised and incomplete. This leads to decisions being made without all the available information at hand, significantly increasing the associated risk. Moreover, the credit scores are not updated in real time, with the delay prejudicing millions of consumers and businesses as their current credit history is not factored into the decision making process

Solution Credito

As a solution to the above problems, we have created the Credito Network, or simply Credito. A decentralized network based on Ethereum blockchain coupled with smart contracts and Interplanetary File System (IPFS) providing Credit Intelligence and Decentralized Lending Marketplace. Credito encourages the expanding and proficient operation of the credit industry by permitting both fiat and digital resource loan specialists to broaden credit to people and establishments with underdeveloped or a juvenile credit framework. The ecosystem provides solutions to enable any verified lender to safely and securely issue credit to the verified borrower.

Decentralization provides more security and trust. It is a method to organise anything in a way that does not require trust on third parties. The trust is eliminated by executing code that does not require centralized governance, management, or servers. By decentralizing lending, we do not require banks or any other intermediaries for conducting a loan transaction.

Decentralization through the use of Smart Contracts also removes any trust requirement between borrowers and lenders, providing a trustless and transparent lending environment unavailable in today’s market.

Smart Contracts achieve this through their pre-defined parameters removing the need for trust between participating parties. They are also entirely transparent and viewable by anyone using an Ethereum blockexplorer.

Credits — The Credito Network Token

Credits are ERC20 tokens which serve as the currency, governance mechanism and rewarding system with in Credito. Credito will be able to set prices and receive payment for their services in the form of Credits.

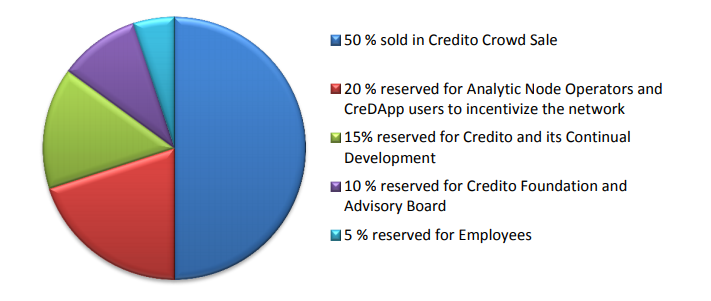

Token distribution

In order to undertake further development, Credito will conduct a one-off Token Generation Event (“TGE”) and crowd sale of Credits, where 50 % of the Tokens will be made available for public sale. The start date of the TGE will be announced soon, and it will allocate a total Credits supply of 1 billion as follows:

- Employee allocation will have a vesting period of 12 months, 25% vesting each quarter, with a 6 month cliff. Allocation will be proportional to the tenure of each employee by the date of token sale.

- Credito Foundation allocation will have a vesting period of 12 months.

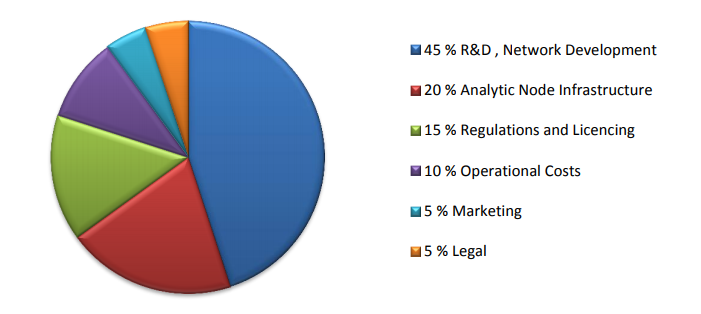

Projected use of funds

Roadmap

Credito will be developed in 6 stages accomplishing a major milestone at each stage.

Stage1 Accomplished

- Concept and Research.

- Credito Incorporation.

- Whitepaper.

- Proof of Concept — High Speed Transaction Scoring System.

- Website Launch.

Stage 2 User Registration, Verification and Partnerships

- CreDApp front end Development

- User Registration

- Automatic ID verification

- Work on partnerships with financial institutions

Stage 3 Infrastructure and Intelligence development

- External API Development.

- Analytic Node Infrastructure.

- Credito Scoring Engine Development.

- Credit Scores generation.

- Transaction scores modeling.

Stage 4 Smart Contract Development and Deployment

- Scoring and Leasing smart contract development.

- Smart contract Audits.

- Integration of smart contracts with Credito Analytic Engine and Node Infrastructure.

- Launch on Test net.

- Test net trial delivering live scores to the partners.

Stage 5 Launch

- Main net Launch.

- Complete Decentralized Credit Intelligence available for partners.

- External Analytic node Operators joining the network.

- Marketing and new partnerships.

Stage 6 End-to-End lending protocol on Main net

- CreDApp and Mobile App development

- Credito Smart Credit Agreement development and Audit

- CreDApp backend with Integration of Credito Smart Credit Agreement

- CreDApp on Test net and progression to Main net

Team

Founding Team:

-

Srikar is Creative and Entrepreneurial, backed by his strong technical expertise, a technology enthusiast, and avid believer of blockchain, decentralization. He designed and developed several High Speed Transaction Processing Engines and Scoring Engines for low latency systems. Demonstrated over 10 years of experience in delivering cutting edge technology products across domains like Finance, Data Communications, Medical and Embedded systems.

-

Naren is Technology Expert. He founded Bang Music Factory to standardize, improve, and globalize the music production process by publishing it through secure Mobile apps. He is part of architecture team for in-house trading system and responsible for code quality compliance at Bank of America, He has vast experience in building algorithms for various domains including finance and banking and passionate on Blockchain, Network and distributed technologies. As an Expert in C, C++, Python and having mentored experienced professionals, Naren brings in his vast experience from organisations like Microsoft, Cisco and Bank of America in to Credito.

-

Haranadh is an Entrepreneur, Data scientist, Fintech Specialist and Vice President of UangTeman.com. He founded PH Technologies. He did Masters in Machine Learning from Indian Institute of Technology, He has an international publication on machine learning which is in a best paper race. His professional research experience covers service in Defence Research and Development Organisation Statistical Analysis Group and many areas like Cryptanalysis, Operating systems, Storage and Virtualization. His recent focus is on identifying and building systems to assess credit risk in Banking domain, especially in the area of unsecured loans and conducting several studies to identify surrogate variables to assess credit risk and match and exceed traditional banking practices by building credit risk algorithms with-in data science platform, big data analytics.

Advisors:

-

Dale has extensive experience in Strategic planning. He is an Executive Manager, Group Advisory at Commonwealth Bank. He led national level projects at National Australia Bank. Having worked with two of the Big Four banks in Australia, Dale brings his extensive knowledge of banking, finance and strategy in to Credito.

To know more about Credito do not hesitate to visit the following link:

- Website: https://credito.io/

- Whitepaper: https://credito.io/pdf/whitepaper.pdf

- Announcement: https://bitcointalk.org/index.php?topic=2483679.0

- Facebook: https://www.facebook.com/CreditoNetwork

- Twitter: https://twitter.com/CreditoNetwork

- LinkedIn: https://www.linkedin.com/company/credito-network

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=1255738

Tidak ada komentar:

Posting Komentar